Lisbon was one of several countries I visited during a trip around southern Europe and because its currency is the euro, it was easy to travel between nearby European Union countries without having to exchange currency.

However, If you’re traveling from another part of the world or EU nations that have opted out of using the euro, like Denmark, the Czech Republic, Hungary, and Sweden, you may need to exchange a bit of cash.

This post discusses using the euro in Portugal, exchange rates, whether credit cards are better than cash, where to exchange cash, using ATMs, and more.

The information is based on my experience, input from our local tour guides, and tourists who have had the same questions you probably do.

- What Currency Is Used in Lisbon

- Exchange Rates

- Cash vs. Credit and Debit Cards

- Exchanging Currency

- Withdrawing Cash From ATMs

- Tips From Locals & Travelers

What Currency is Used in Lisbon and Portugal

As a member of the European Union, Portugal’s official currency is the euro. The currency symbol of the euro is € and its official abbreviation is EUR.

The euro comes in these denominations of banknotes and coins.

- Euro banknotes: €5, €10, €20, €50, €100, €200, and €500.

- Euro coins: 1-cent, 2-cent, 5-cent, 10-cent, 20-cent, 50-cent, €1, and €2.

One cool thing about some euro coins is that some countries choose to imprint a national image on one side of certain coins while the other side has the common euro design.

In Portugal, the national side of coins features castles of Portugal, the country’s royal seals, and its coat of arms.

Keep your eyes open for these pretty coins when you are there. Other countries that have a national side of euro coins are Germany, Ireland, Greece, Spain, France, Italy, the Netherlands, Austria, Belgium, Croatia, and even Vatican City!

Exchange Rates for the Euro

Among the most common conversions into euros are from the U.S. dollar (USD), the Canadian dollar (CAD), the British pound (GBP), and the Australian dollar (AUD).

As of late March 2024, the following exchange rates apply for these currencies:

- $1 USD is equal to around €0.90 and $100 is equal to roughly €90.50

- £1 GBP is equal to about €1.17 and £100 is equal to approximately around €117.47

- $1 CAD is equal to around €0.68 and $100 is equal to about €67.80

- $1 AUD is equal to around €0.60 and $100 is equal to about €60.45

Remember that exchange rates fluctuate daily, even hourly, due to factors related to financial market conditions.

You can see real-time exchange rates for international currencies at the currency converter website, xe.com.

Cash vs. Credit and Debit Cards

Before exchanging money, it's good to know just how much cash, if any, you will need in Portugal.

In Lisbon and other big cities like Porto, many big establishments will accept credit or debit cards.

But you cannot count on this 100%, so have euros handy, perhaps between €20-€50. If you end up not having enough for your day, you can always go to an ATM (see section below).

Have some small notes or coins as small shops may not be able to make change for large notes.

Also, you might want to tip a few extra coins for exceptionally good service, though tipping is not customary in Portugal.

Outside of big cities, be sure to have euros handy as you will likely need them at some point.

If you plan to rent a car, you will need cash and coins. Street parking meters in Lisbon require coins. Some toll roads will only take cash, not cards.

As for using credit and debit cards, MasterCard and Visa are most commonly accepted. Some places may also take American Express.

You can look for the logo on the door or window of the establishment. When in doubt, ask before making a purchase.

More and more, contactless payment, Apple Pay and Google Pay are utilized in European countries.

While Portugal is on Apple's list of participating countries, we think it unwise to rely on your iPhone or smartwatch to pay for things.

Good to know:

As of 2023, the Lisbon metro public transport will accept contactless payments (tap-to-pay) at the gates of all stations. You can use a debit or credit card, or your cell phone or smartwatch with Apple Pay and Google Pay.

Tip: Travel with more than one credit card or debit card. It’s wise to have an alternative should you encounter any problem with one of them.

Exchanging Currency

Since it is a good idea to have some cash on you, here are our suggestions on where to exchange money and where not to.

Before you depart

First, you may want to exchange a small amount before you depart your home country. Just so you have some cash when you get off the plane, for a bottle of water or snack at the airport.

You can do this at most banks. Ask your bank if they can do the exchange and perhaps they will waive any fee if they charge one.

Avoid exchanging at your arrival airport

Upon your arrival in Portugal, avoid exchanging currency at the airport. You will receive an awful exchange rate and will pay a high service fee.

Where to exchange currency

In the past, banks were one option to exchange currency, but most Portuguese banks no longer offer this service.

Now, the best option is currency exchange outlets (“cambios”).

If a cambios says there is no fee or 0% commission, don't be fooled into thinking they are doing you a favor. It just means you are getting a less favorable exchange rate.

Again, check the exchange rate on xe.com to make sure that you are getting as close as possible to the standard rate.

Some cambios may ask for ID, so carry your passport with you if you plan to exchange currency.

Here are some reliable cambios companies with locations throughout Portugal, and with multiple locations in Lisbon.

While going to a cambios is fine, the most convenient way nowadays is to get cash from an ATM.

Withdrawing Cash From an ATM

Withdrawing cash from an ATM is a convenient alternative to going to a cambio.

It is always best to use your debit card rather than a credit card.

There are some important things to know before using an ATM in Portugal.

1. The Multibanco ATMs are the machines you should use. The machines will say MULTIBANCO and have an MB symbol.

These ATMs are part of a network of many top Portuguese banks and though you will be charged a fee for using it, it will be around 1-2% of the amount you withdraw.

2. Avoid using private network independent ATMs managed by Euronet as the service fees may be as high as over 10%.

3. As you will be using a non-Portuguese bank card, you will be offered a choice of exchange rates: euros or your own bank’s currency.

Choose EUROS for the best conversion rate. If asked twice, decline/reject the option both times.

4. If the ATM asks for a 6-digit PIN, but you have a 4-digit PIN, enter it and press OK. It should work just fine.

5. Withdrawal limits for ATMs in Portugal are typically set to €400 per transaction, though it may vary by machine.

6. Most ATMs will let you choose your bill denominations. Choose small bills since most cash-only vendors will not want to break large bills.

The video below is very helpful. Click on the CC button at the right-hand bottom of the video for captions in your language.

In terms of ATM safety and fraud in Lisbon, it is generally safe to use ATMs but be on the lookout for ATMs that look tampered with to avoid any incident.

Also, try to go to an ATM at a bank that is open in case of any problem such as the machine ‘eating’ your card.

Finally, always shield your hand when entering your PIN. This is a good idea no matter where you are.

Currency Tips From Locals and Travelers

While we hope this post answers all your questions, it is always good to hear what other people think, especially locals and tourists who may have had the same questions as you.

Here are suggestions on the topics covered in this post from members of a few Lisbon and Portugal travel groups on Facebook like Travel Portugal.

Cash vs. Credit Cards

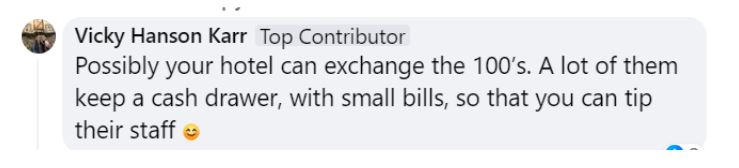

As we noted in this post, it is good to have some cash with you, even if you plan to use a credit card most of the time. The replies to Jessica’s post confirm this.

Sandra, Anita and Natalie agree that it is best to have some cash for small restaurants and cafes and for small purchases.

Using ATMs

Here we have Igor’s experience and instructions for using ATMs in Portugal. He is spot on!

Zimmadia reported that using her debit card at a Multibanco ATM and rejecting the conversion rate got her a great deal on the exchange rate.

Again, as a reminder, when you do use an ATM, make sure to get small bills.

While the ATM should dispense small bills yet somehow you end up with big bills like 100s, you may encounter difficulty getting change.

Vicky’s suggestion below is very wise is helpful.